"I spent all day just setting up MT4" or "In the end, I couldn't keep up with manual verification." If this sounds like you, it's not due to a lack of effort—it's likely because your chosen "method" doesn't meet 2026 standards.

The essence of backtesting lies in "analysis"—judging whether a strategy is actually good. I have organized the shortest route to ensure you don't melt away your time on preparation and busywork.

In 2026, FX Backtesting Doesn't Require "Grit"

In the past, spending months manually recording data was considered a virtue, but in this day and age, that time is simply wasted. First, check what level of "cost" you are currently paying for your verification.

1. Manual Verification (Screenshots & Excel)

- The Cost: Massive amounts of time and "subconscious lies (bias)."

- The Reality: While no special tools are needed, rules tend to blur, making reproducibility almost zero. It often becomes a collection of "memories of winning trades" rather than a real test.

2. System Verification (MT4 / MT5)

- The Cost: Advanced IT skills and the "stress of environment setup."

- The Reality: The accuracy is high, but managing historical data and EA settings creates a "wall before you even start analysis" that is so high 90% of people give up here.

3. Next-Gen Verification (Delver)

- The Advantage: Zero setup. Start analyzing the moment you open your browser.

- The Reality: By automating "work" to the extreme, it creates an environment where traders can concentrate on "judgment and improvement," where their time is most valuable.

The "4 Shortest Steps" to Successful FX Backtesting

A standardized procedure for producing high-precision results without wasting time on prep.

Step 1 | Choose an Environment Where You Can Skip "Setup"

Exhausting yourself with data downloads and settings before you even verify is a strategic mistake. Secure an environment where charts move immediately after logging in, allowing verification with tick-data-level precision.

Step 2 | Verbalize Rules to Block Your "Escape Routes"

Before running any tools, document the following three points in writing:

- Entry triggers (specified numerically)

- Clear "skip" conditions

- Absolute rules for Stop Loss and Take Profit

If these are vague, even the most sophisticated tool will be contaminated by "hindsight bias."

Step 3 | Treat "100 Trials" as One Set

Being swayed by the results of 10 or 20 trades is just reflecting on a gamble.

- Kill your emotions and accumulate logs for over 100 trials.

- View them as "statistics" rather than individual wins or losses.

Whether you can cycle through this phase quickly determines your backtesting ROI.

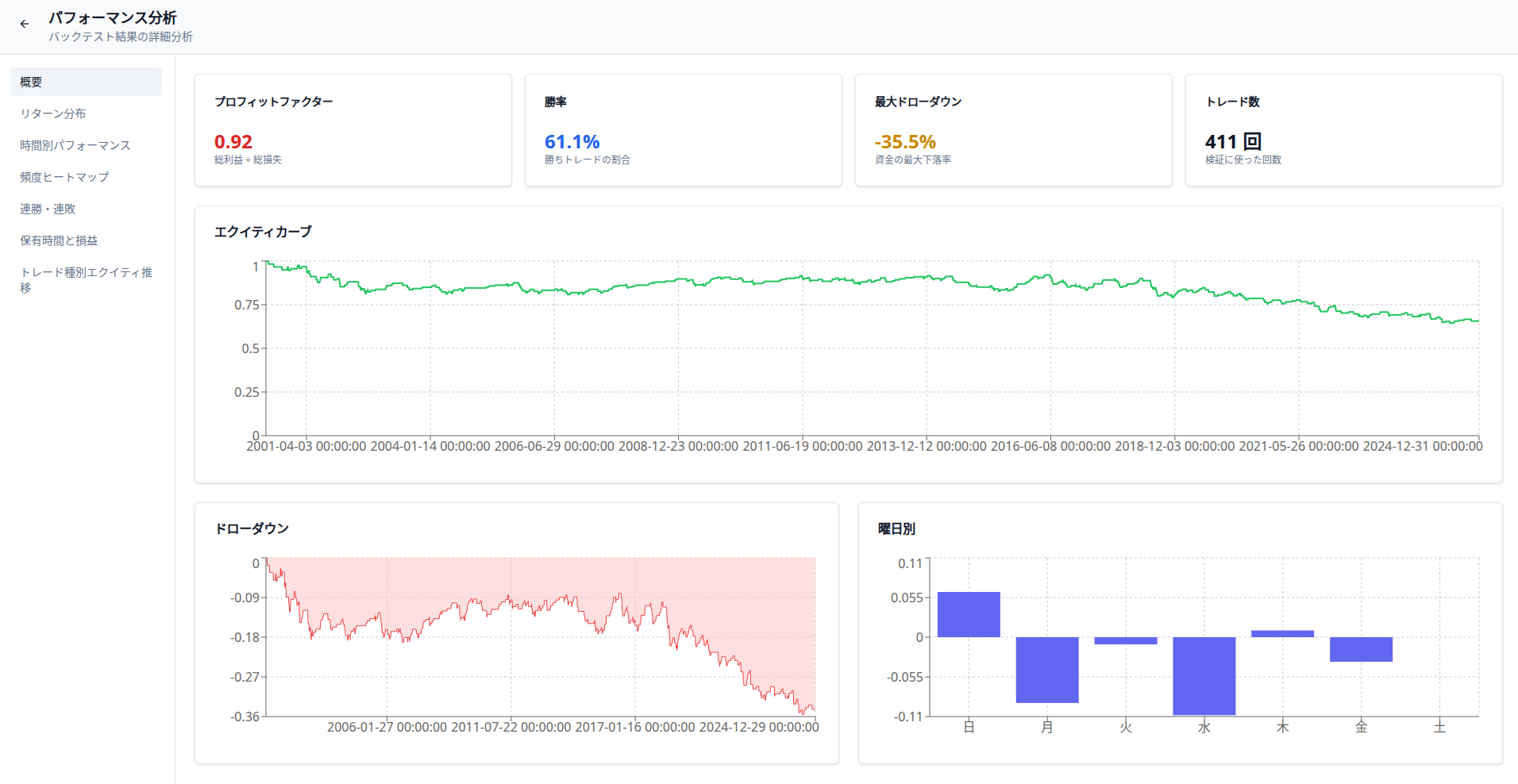

Step 4 | Forget Win Rates; Analyze "How it Breaks"

Finally, analyze the accumulated data from multiple perspectives.

- Max Drawdown: How much the capital dips.

- Stagnation Period: How many days pass without profits reaching a new high.

- Equity Curve Variance: Was that win just a "fluke"?

In the deep-dive articles below, I explain how to spot the risks hidden behind the numbers.

Comparison: Spend 3 Days Building MT4, or Verify 100 Times Right Now?

Even within "backtesting," there is an overwhelming difference in results and speed.

| Item | MT4 / MT5 | Delver |

|---|---|---|

| Time to Start | Days for data acquisition/setup | 0 seconds (Browser only) |

| Difficulty | Programming/IT knowledge required | Simply enter your conditions |

| Main Output | Standard reports | Detailed DD analysis & Equity curves |

The image below is the backtest analysis screen of Delver.

Professional traders don't spend their time setting up indicators. They spend it on the analytical work of "how to modify the strategy based on the results produced."

Summary | The Correct Method Means "Leaving Time for Analysis"

If you get the backtesting method wrong, you will never gain the confidence to use even the best strategy in live trading.

- Don't get exhausted by "preparation."

- Physically block out "bias."

- Look at multi-faceted data beyond "win rate."

Verification in 2026 is determined by "design," not "grit."

I have also prepared a comparison article to help you find the best verification tool for your style. Please take a look.