Is Your "Verification" Actually Reproducible?

Most traders believe they are "verifying" their strategies. In reality, most of what they do is not verification—it is a memory game.

Redefining "Backtesting" for Success

Commonly, backtesting is incorrectly defined as:

- Hunting for winning setups.

- Counting "good-looking" entries on historical charts.

- Considering a strategy valid if the final result is positive.

This is not backtesting. Hunting for winning points ≠ Verification.

True verification is the process of confirming:

"Can my future self make the exact same decision, under the exact same conditions, in the exact same way?"

The Danger of "Selective Winning Memories"

The human brain is wired for convenience:

- We remember winning trades vividly.

- We vaguely forget losing trades.

- We categorize "near-misses" or "almost wins" as actual wins.

At this point, your verification data is already quietly rotting.

If you are using manual verification or replay features, this is a must-read:

Verification Without Reproducibility is Just Entertainment

Let's be blunt: Backtesting without guaranteed reproducibility will not improve your trading skills by a single millimeter, no matter how many hundreds of hours you invest.

The Goal of Verification: Reproducibility over Confidence

There is a common misunderstanding:

- "I have confidence, so I can reproduce it."

- "I won many times, so it’s reproducible."

These are entirely different things. In the world of data, it is a frequent phenomenon that the more confidence you have in a discretionary method, the lower its reproducibility.

Why Your Results Fail the Very Next Month

When the losses start, traders blame the market:

- "The market environment changed."

- "Volatility is different."

- "The market is broken."

In most cases, the real reason is:

Your decision criteria were vague from the very beginning.

The 5 Deadly Sins (Biases) Destroying Your Reproducibility

This is the core of the issue. Almost every backtesting failure falls into one of these categories:

1. Hindsight Bias

"Ah, I would have entered here."

The moment you say this, your verification is dead.

- Assigning reasons to a setup after the candle has closed.

- Ignoring the hesitation you would have felt in real-time.

Hindsight is 100% fiction.

2. Survivorship Bias

- Losing patterns are left out of the logs.

- Only winning trades are saved as screenshots.

- The conditions that led to failure are forgotten.

The result is an "Imaginary world of only survivors."

3. Data Snooping (Selective Period Clipping)

- "This method worked great in the last six months."

- "Last year was bad, so I’ll exclude it."

The moment you shift the time window, the strategy collapses.

4. Confirmation Bias

- You only notice setups that prove your hypothesis correct.

- You stop analyzing losing trades.

Verification turns into an exercise in self-affirmation.

5. Look-Ahead Bias

- You unconsciously know what happens on the right side of the chart.

- Even in "replay mode," the overall trend is already in your head.

Complete elimination of this is impossible in manual MT4 or TradingView replays.

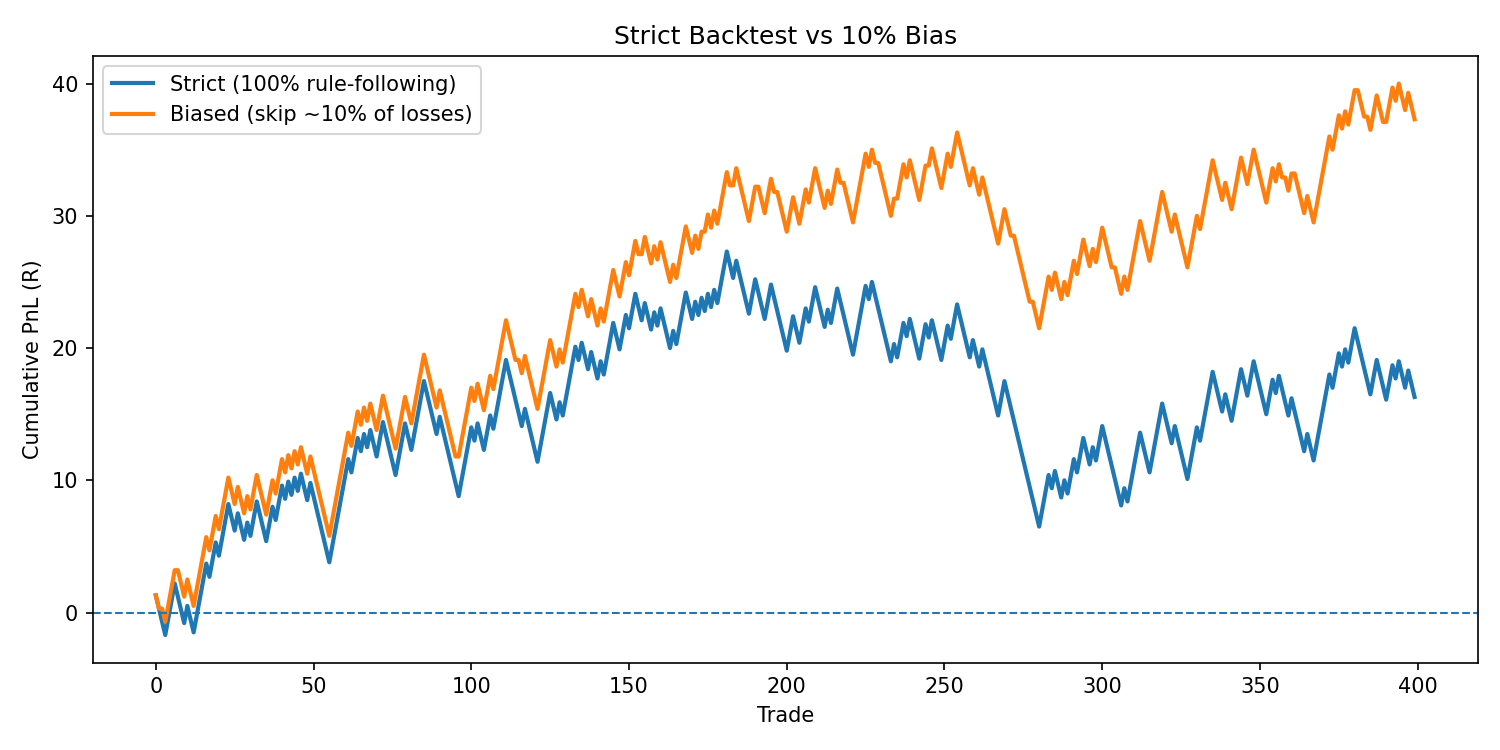

[Experiment] How a 10% Bias Destroys Your Expectancy

Let's look at the data, not emotions.

"Strict Rules" vs. "10% Convenient Interpretation"

Compare two strategies with the same theoretical expectancy:

- Blue Line: 100% Rule Adherence.

- Red Line: 10% Bias (Deciding "I wouldn't have taken that" for 1 out of 10 losses).

The result is clear:

- The Red Line looks beautiful.

- Drawdowns are shallow.

- It looks psychologically easy.

But it is fake. This 10% "softness" makes the strategy impossible to replicate in reality.

Why Can’t We Sense Our Own Biases?

The Brain is a "Loss Avoidance Machine"

The human brain is not a profit-maximization tool or an accuracy-focused processor. It is a loss-avoidance specialist. It has the built-in function to justify losses and rewrite memories to protect your ego.

"Being careful" is not a solution. Your subconscious is always stronger than your conscious effort.

The Structural Limits of Manual Backtesting

Why MT4/TradingView Replays Aren't Enough

- You still see the "future" context.

- Fills and spreads are always ideal.

- Decisions are not logged objectively.

When Screenshot/Memo Verification Fails

- Records are vague.

- Criteria shift over time.

- You never truly review the failures.

The Requirements for Reproducible Verification

100% Verbalized Criteria

If you can't write down exactly why you hesitated or why you skipped a trade, that trade is not reproducible.

The "Third-Party Test"

If another person cannot execute your rules with the same results, your reproducibility is zero.

The Only Realistic Way to Eliminate Bias

Design for Human Distrust

You need a system where:

- Decisions are logged automatically.

- Conditions are fixed.

- Parameters cannot be changed after the fact.

Backtesting tools are not for "making things easy"—they are devices built on the premise of human weakness.

Conclusion | The Danger of "Thinking" You Verified

What percentage of bias is mixed into your results?

If you can't immediately answer "0%," your verification is worth redo-ing.

Reproducibility is a Design Choice, Not a Talent

Surviving traders do not trust themselves from the start. Backtesting is not a battle with yourself; it is a battle of System Design.

With Delver, you can instantly visualize your true performance by excluding outliers and analyzing DD distributions that don't appear in simple Profit Factors. Confirm for free today that your strategy isn't just a "paper tiger" built on numbers.