Why "Positive Expectancy = Profitable" is a Lie

In the trading world, the phrase "This strategy has a positive expectancy" is often treated like a victory declaration.

However, in reality, periods where capital continues to decrease despite a positive expectancy are completely normal.

This is not an exception; it is a phenomenon that inevitably occurs due to the structural nature of probability.

Expectancy is Only a Matter of "Averages"

Expectancy is the average value over an infinite number of trials.

What individual traders actually face are:

- A finite number of trades

- Limited capital

- Limited mental durability

Within these constraints, the vast majority of traders drop out before their results ever converge to the average.

As a prerequisite for this article, you first need to know your win rate and drawdown (DD). Tools to easily find these are summarized here:

Individual Traders Drop Out Before Reaching the Average

Expectancy is a long-term story. Ruin is a mid-process story.

Unless you understand this gap, you will never escape the contradiction of "winning in theory, but losing in reality."

Expectancy and Equity Curves are Completely Different Things

Infinite Equity Curves Exist for the Same Expectancy

Even for strategies with the same win rate and Risk-Reward (RR), an infinite number of equity curve shapes exist. This is because the sequence of trade results is not fixed.

Why Sequence (Order of Trades) Governs Results

Whether wins come first or losses come first determines everything:

- Intermediate drawdowns

- Mental load

- Ability to continue the strategy

What is Equity Curve "Variance"?

Strategies with High Variance Look "Rougher"

Variance is the property of how scattered trade results are. Strategies with high variance feature:

- Massive wins

- Massive losses

- An equity curve that fluctuates violently up and down

Volatility Exists in the Equity Curve, Not Just Price

Most people think volatility is only about price movement. However, the equity curve itself has volatility. And it is not the price, but the volatility of the equity curve, that breaks the trader.

Periods of Continuous Capital Loss are Guaranteed to Occur

Short-Term Negatives are Not Abnormal

Even with a positive expectancy strategy, periods of continuous losses over dozens or even hundreds of trades occur naturally. This is not an emergency.

The Real Problem is "How Long It Lasts"

What is fatal is designing your money management and mental state without anticipating these periods.

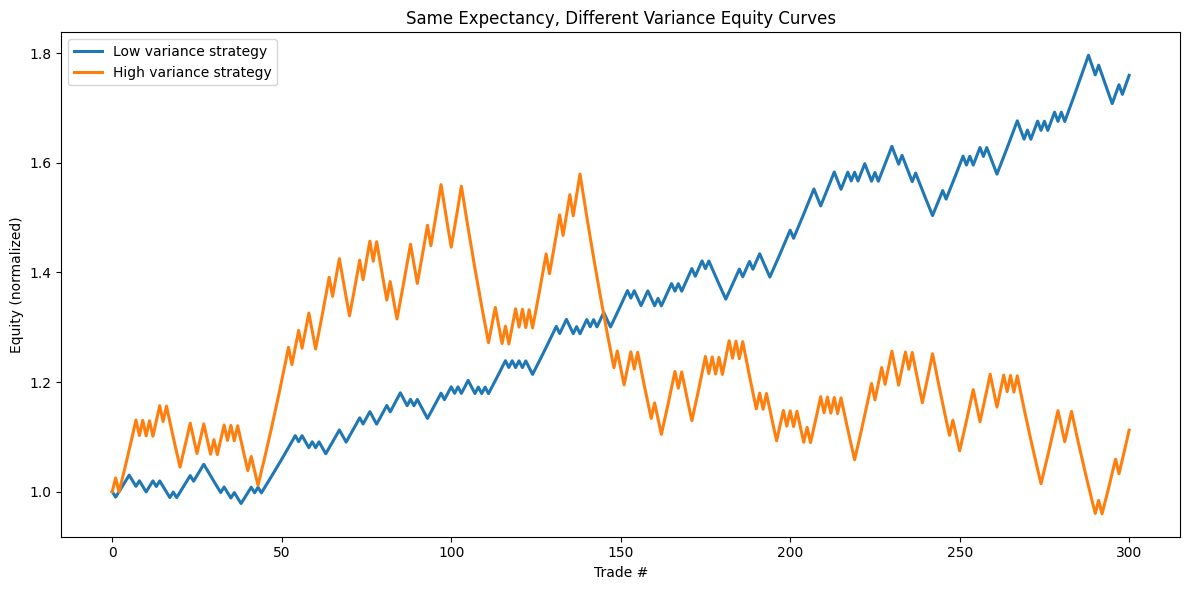

[Visualization] Equity Curves with the Same Expectancy Can Be This Different

Monte Carlo Simulation Prerequisites

Below are the results of simulating two strategies with the same expectancy.

The only difference is the variance (scatter) of profit and loss per trade.

Why Steady Growth and Ruin Coexist

Even though the final expectancy is the same:

- Blue line: Progresses relatively smoothly.

- Red line: Fluctuates violently, creating unbearable situations halfway through.

The pain you feel is determined by variance, not expectancy.

Why Variance is Ignored in Most Verifications

The Problem of Looking at a Single Equity Curve

Most verifications end with:

- One backtest

- One equity curve

But that is just one possibility out of countless others.

The Psychology of Judging by "Final Profit/Loss"

People tend to think they were "right" as long as they won in the end. The possibility that they might not have endured the journey disappears from the verification.

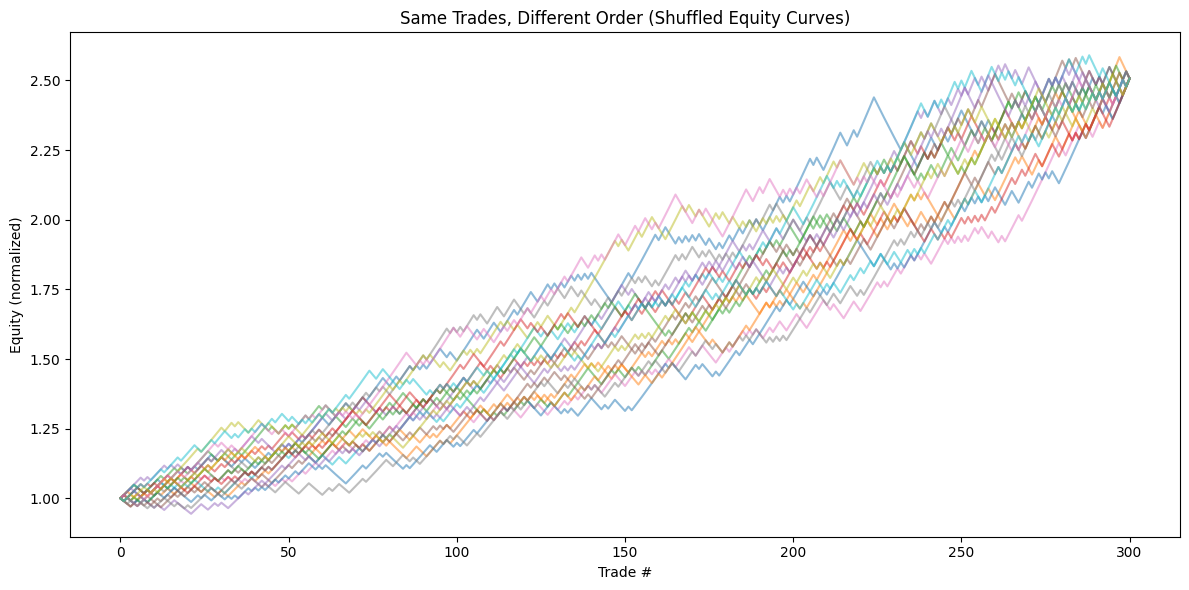

[The Violence of Sequence] Comparison of "Shuffled" Trade Results

Below are equity curves generated by shuffling the order of the exact same 100 trade results.

The final profit/loss is identical for everyone. However:

- Maximum drawdown

- Intermediate psychological load

...are completely different for each. There is a high probability that the reason you are losing right now is not the strategy, but simply the "sequence."

The importance of drawdown is further explained below:

Metrics to Look at Before Expectancy

Variance, Standard Deviation, and Downside Risk

Before looking at expectancy, you must examine:

- Variance

- Standard deviation

- The depth and length of downside "draws"

Always Evaluate Expectancy and Risk as a Set

Looking at expectancy alone is like evaluating a car that has no brakes.

The following article explains in detail how to interpret results using actual data and graphs:

The Moment Equity Curve Variance Destroys Trading Judgment

Intermediate Negatives Distort Rules

Long periods of stagnation:

- Make you doubt your entries

- Force you to change lot sizes

- Lead you to break your rules

"The State of Not Believing in Expectancy" is the Greatest Enemy

The moment you can no longer believe in the theory, trading shifts from statistics to emotion.

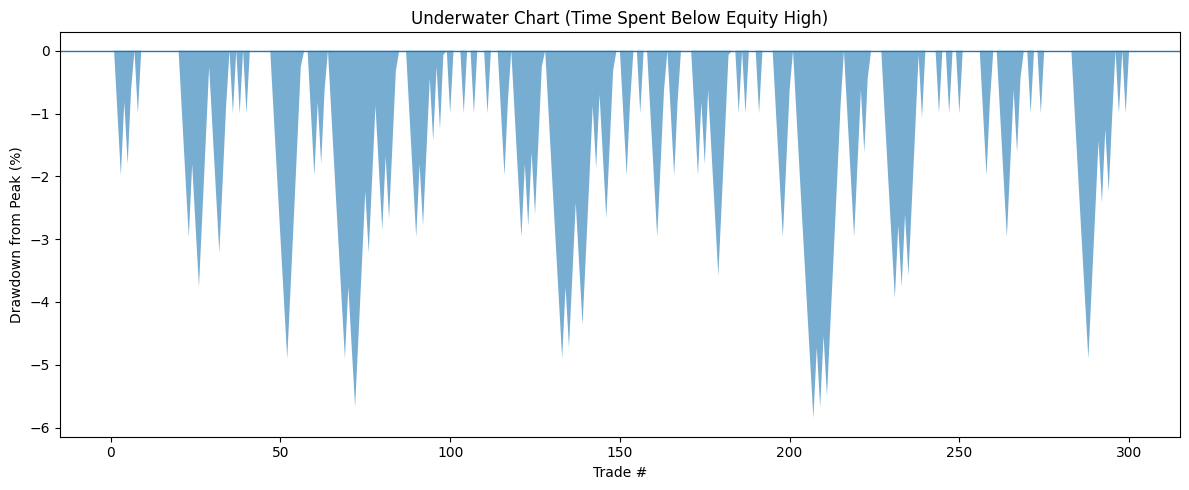

[The Reality of Stagnation] Underwater Chart

Next is a graph showing only "how much time has passed without reaching a new capital high."

Even with a positive expectancy strategy, most of the time is spent in periods where you "don't feel like you're winning."

Points to Truly Confirm During Verification

View Equity Curves Through Multiple Paths

Verification is not looking at one result, but looking at multiple possibilities.

Build Money Management Based on the Worst Case

Don't design for "It'll probably be fine"; design for "Can I endure the worst case?" Cases where the verification method itself is wrong are not uncommon.

In 3 Reasons Why You Lose Despite Verifying | Fatal Mistakes in Manual Testing Done by 90%, we introduce settings that are reproducible and close to real trading.

Summary | Positive Expectancy Only Matters Under "Certain Conditions"

Expectancy is a Prerequisite, Not a Goal

Expectancy is merely the condition required to stand at the starting line.

There is No Value in Expectancy That You Cannot Survive

An expectancy with a variance you cannot endure is mere armchair theory. The question in trading is not whether you can win, but whether you can survive.

The next theme to understand is: The Trap of Win Rates and PF | Spotting "Curve Fitting" Hidden Behind the Numbers.