Introduction

In FX and stock trading, the term "Holy Grail" is frequently heard. Usually, it refers to a "strategy that never loses" or a "perfect timing for 100% success."

Whether such a thing exists is a point I will skip, as I have never seen or been convinced by one.

In this article, I will explain the true purpose of verification and backtesting, and how to conduct them so that the process actually becomes meaningful.

What is the Purpose of Verification?

When people hear about verification in FX or stocks, they likely imagine manually rewinding charts, writing and executing code, or purchasing EAs to see their automated trading performance.

There are various ways to backtest, but for now, let's group them under the term "verification." But first, what is the goal?

Most people think verification is simply "checking if the strategy is correct."

However, that is insufficient.

Finding Winning Conditions

You might think this is the same as "verifying a winning strategy," but it is entirely different.

It means identifying "under which conditions do I win?"—such as specific days of the week, time zones, currency pairs, or market environments.

If you cannot identify the winning conditions, the verification loses its purpose.

Finding Losing Conditions

This is also extremely important.

In fact, it is the most critical part of verification.

Once you identify the conditions under which you lose, you can stop trading under those conditions forever.

Theoretically, the more losing conditions you know, the less you will lose.

It sounds obvious, but many traders who lose are simply repeating the same losing patterns over and over. I have done this many times myself.

Confirming Reproducibility

Trading without reproducibility is just gambling.

Looking for a slot machine with positive expectancy is more rational and reproducible.

For example, if a backtest shows a total profit for a strategy, look for the commonalities.

If entries made when multiple filters align are winning, those filters are worth adopting in live trading.

When you win every time all filters trigger, you have discovered true reproducibility.

The "Drip" Process

Based on the points above, verification is the act of layering various filters and "dripping" out the refined results.

This process is not based on intuition; it is the optimization of conditional probability.

A simple rule like "buy when the Moving Average golden crosses" is a wasted opportunity.

Filtering by Day and Time

These are crucial elements. It is widely said that Fridays and Mondays are risky due to market volatility. This is an excellent theme to exclude and verify.

Multi-layered Filtering via Price Action and Patterns

In addition to numerical filtering with indicators, filtering by shape (patterns) is extremely effective.

However, environments where you can strictly verify these are limited.

For individual traders, using the pattern recognition engine in Delver is the most efficient route. If you handle Python and want to pursue shape similarity at a higher level, libraries like FAISS (Facebook AI Similarity Search) allow you to rapidly extract specific chart shapes from millions of data points.

Examining Correlation with Interest Rates

This is another great filter. For example, verifying a "no shorting" rule when US interest rates are higher than Japanese rates can yield valuable insights.

Verifying High Win Rates with Multiple Indicators

Combine RSI, GMMA, MACD, and Bollinger Bands, and enter only when all indicators meet specific conditions.

By doing this, even if the number of entries decreases, those that remain are likely to have very high expectancy.

By layering these various filters, you achieve higher precision and, above all, highly reproducible trades.

The key is to layer many filters to "drip" away the noise and find pure, clean conditions and environments.

The Secret of the Drip: The Mathematical Background of Conditional Probability

Why can't you win with a "single indicator"? The answer lies in "Conditional Probability" in statistics. Let the win rate of a simple golden cross be $P(A)$. Now, let's layer filter $B$ (higher timeframe is in an uptrend) and filter $C$ (RSI is not oversold). The formula we need to know is:

P(A ∩ B ∩ C)

P(B ∩ C)

In other words, it is "the probability that event A (winning) occurs given that conditions B and C are simultaneously met."

Verification is not just chasing signals. it is the work of identifying the points that maximize expectancy by optimizing the combination of "filters (conditions)" and dripping out the impurities. A strategy that has not undergone this mathematical process of "dripping away low-expectancy points" is just a "wish," not a strategy.

Manual Verification

This refers to TradingView's Replay Mode.

As mentioned, filtering multiple factors is key, but how do you do it manually?

Rewinding charts to verify many filters manually is exhausting.

However, in practice, you have to do it. So how?

I won't discuss whether discretion or automated trading is more advantageous here, but I want to touch upon how to conduct manual verification.

Getting Used to Trading

This is the biggest advantage of manual verification.

In any field, you don't get better without practice.

Just because you hear a winning logic from a world champion athlete doesn't mean you become a world champion by doing it.

The same applies to business; hearing how to start a company doesn't make you a billionaire.

You must get "used" to the act of trading.

Closing the Gap with Reality

This is another major benefit.

The strength of discretionary trading is the ability to trade while considering the "heat" of the moment or fundamentals.

Manual verification allows you to trade with judgments only a human can make, by reading chart movements and looking back at past news.

You might think this leads to non-reproducible trading, but that criticism is nonsense regarding fundamentals, as the world of news is irreversible and lacks literal reproducibility.

Furthermore, there is a view that similar events or news tend to result in similar market trends.

Automated Verification

Unlike manual verification, there are specific points to keep in mind.

This is the method that maximizes the core benefits of backtesting.

Focus on Accuracy

When running automated backtests with MT4 or Python, you first need to acquire price movement data.

You must clean the data for missing values or outliers and then build the entry and exit programs.

While a skilled engineer can do this accurately, it is risky for a non-programmer to use AI-generated code and apply the resulting data to live trading.

With SaaS like Delver, where you simply enter conditions into a form, non-engineers can ensure accuracy using pre-verified data.

Visualizing Results

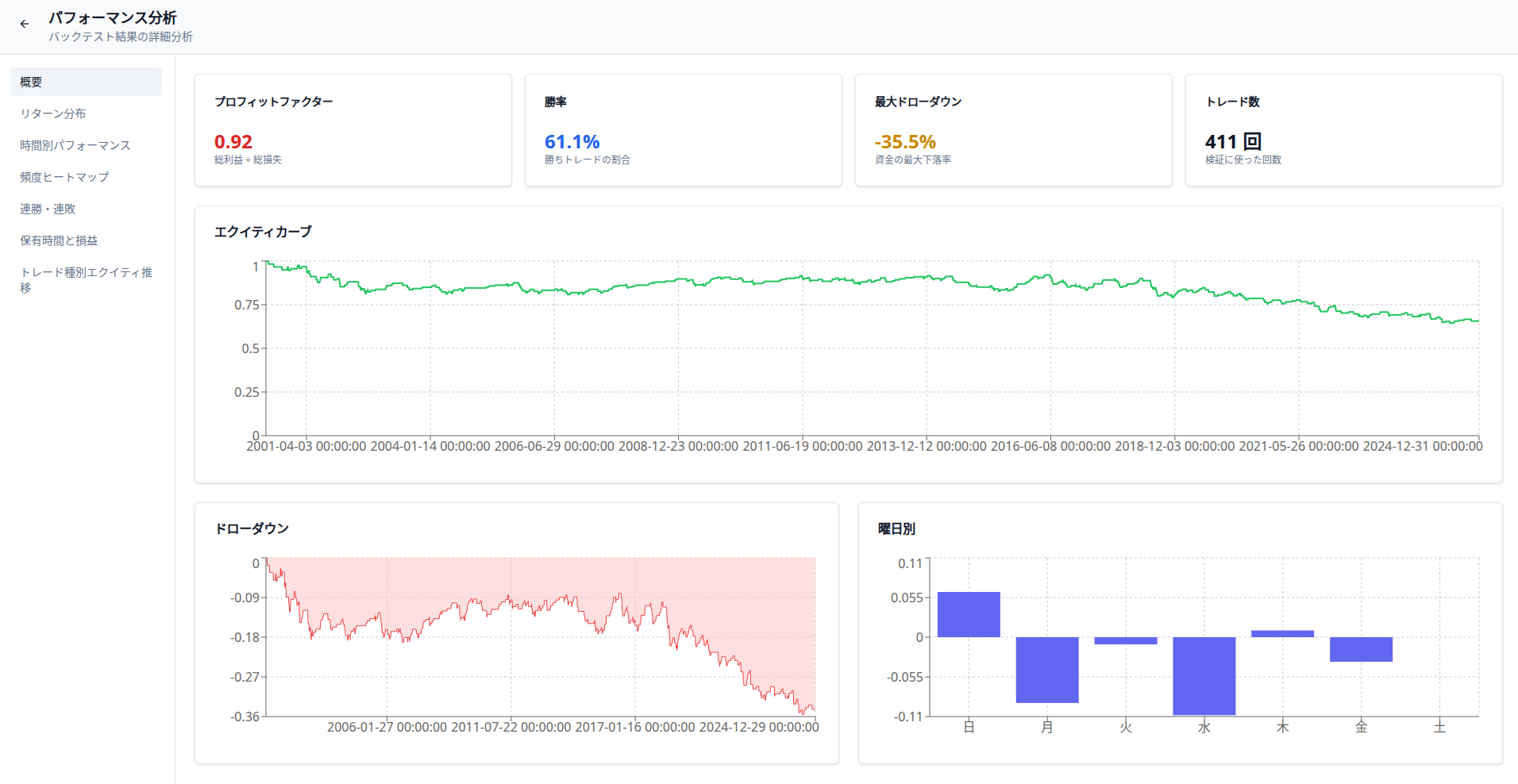

Let's look at a result summary like this one from Delver.

One must be careful with how to read the result summary.

First, suspect curve fitting. Then, look for patterns such as high win rates but high drawdowns, which requires some skill to interpret.

The Worst Choices

So far, I've introduced the mindset for verification, but there are things you must absolutely never do.

Getting data is good, but if that data is wrong, it's a disaster.

Suspect Curve Fitting?

I'm not saying "suspect everything is curve fitting."

In fact, as long as the data exists, "curve fitting" as a purely negative concept doesn't exist in the way people think.

Think about it logically:

- You entered entry conditions.

- It entered according to those conditions.

- It exited according to those conditions.

The result is simply the truth for those conditions. It's not a "biased" result.

Some say, "This strategy only works for this period, so it's curve fitting!" If that's the concern, just verify 25 years of data.

The fact that a strategy worked during a specific period is extremely valuable data. You can assume that on days with similar conditions to that period, the win rate will be high.

"Slow Suicide" by Not Verifying

No athlete goes into a match without practice. Yet, in trading, many people gamble their entire fortune on "intuition."

There is zero benefit to not verifying. It is the statistical equivalent of sprinting through a minefield blindfolded—it is suicide.

Reduce Wasted Entries Through Verification

For a trader, money is inventory.

Throwing away money you worked hard for into a heartless, chaotic market without thought is hollow.

At the very least, you should verify to avoid such wasted entries.

Above all, it is clearly more logical to trade based on numerically backed strategies verified against 25 years of data than to rely on your own limited experience.

There is no need to be the "Emperor with no clothes."

There are plenty of free verification tools available. By comparing them and using one that suits you, you can prevent losses of hundreds of thousands or millions of yen. Isn't it obvious that spending just 30 minutes a day on verification is the right choice?